Overview of Richard Pzena (Trades, Portfolio)'s Recent Trade

On December 31, 2023, Pzena Investment Management, LLC, led by Richard Pzena (Trades, Portfolio), made a notable adjustment to its holdings in Interface Inc (NASDAQ:TILE). The firm reduced its stake by 124,048 shares, which resulted in a 3.43% decrease in its position. This transaction had a minor impact of -0.01% on the portfolio, with the shares being traded at a price of $12.62. Following the trade, the firm held a total of 3,490,324 shares in Interface Inc, representing a 6.00% ownership of the company and accounting for 0.19% of Pzena's investment portfolio.

Investment Approach of Richard Pzena (Trades, Portfolio)

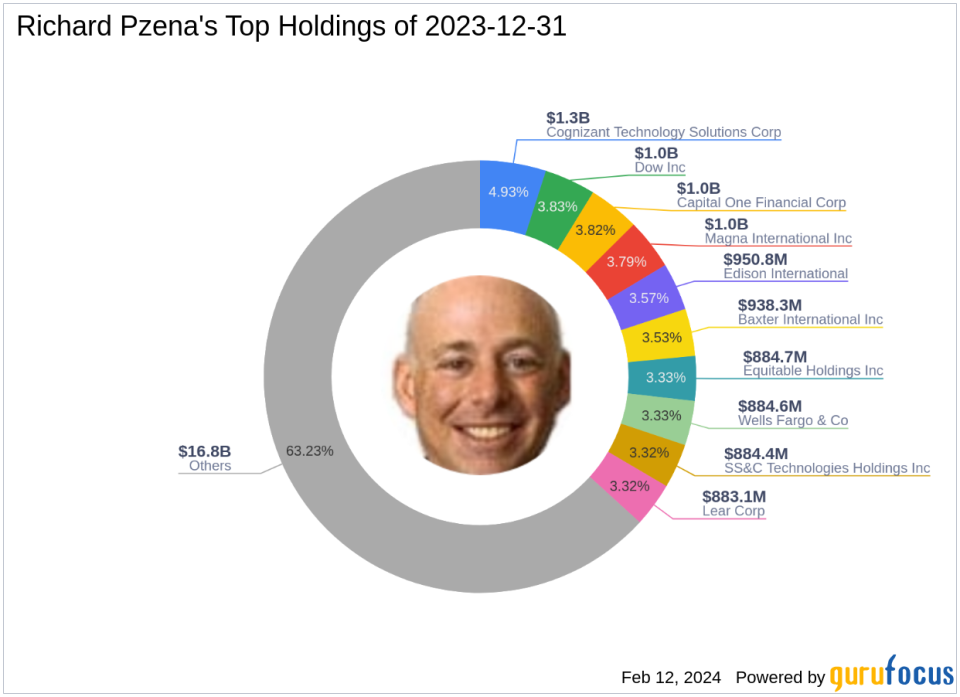

Richard Pzena (Trades, Portfolio), the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, is renowned for a value investing philosophy that focuses on acquiring shares in quality businesses at low prices. The firm, established in 1995, seeks out companies whose share prices have dropped due to temporary issues, aiming to determine the longevity of such problems. With a portfolio equity of $26.6 billion, Pzena's top holdings include Cognizant Technology Solutions Corp (NASDAQ:CTSH), Capital One Financial Corp (NYSE:COF), and Edison International (NYSE:EIX), with a strong focus on the Financial Services and Technology sectors.

Interface Inc at a Glance

Interface Inc, trading under the symbol TILE, is a USA-based company that has been public since September 20, 1978. The company specializes in designing, producing, and selling carpet tile, as well as offering Luxury Vinyl tiles and rubber flooring. Interface Inc primarily serves the corporate and non-corporate office markets, including sectors such as government, education, healthcare, hospitality, and retail. The company operates across the Americas, Europe, and Asia-Pacific regions.

Impact of the Trade on Pzena's Portfolio

The recent transaction by Pzena Investment Management reflects a slight reduction in the firm's confidence in Interface Inc, as evidenced by the 3.43% share decrease. Despite this, Interface Inc still holds a 0.19% position in Pzena's portfolio, indicating a continued investment interest. The trade price of $12.62 is closely aligned with the current stock price of $13.20 and the GF Value of $12.82, suggesting that the stock is fairly valued.

Financial Health and Market Performance of Interface Inc

Interface Inc boasts a market capitalization of $767.012 million and a PE ratio of 1,320.00%, indicating profitability concerns. The company's financial health is reflected in its Financial Strength rank of 5/10 and a Profitability Rank of 7/10. However, its Growth Rank stands at a lower 3/10. The GF Value Rank and Momentum Rank are at 5/10 and 10/10, respectively, with a Piotroski F-Score of 7 and an Altman Z-Score of 2.46, suggesting moderate financial stability.

Sector Focus and Top Holdings of Richard Pzena (Trades, Portfolio)

Pzena Investment Management's sector focus is predominantly on Financial Services and Technology, with Interface Inc fitting into the broader investment strategy due to its role in the construction industry. The firm's top holdings reflect a diversified approach, balancing between growth potential and value opportunities.

Performance Metrics and Rankings of Interface Inc

Interface Inc's performance metrics are a mixed bag, with a GF Score of 75/100, indicating a potential for average performance. The company's momentum is strong, as evidenced by its high Momentum Rank. However, its Growth Rank and GF Value Rank suggest there is room for improvement in these areas. GF-Score

Other Notable Investors in Interface Inc

Apart from Pzena Investment Management, other significant investors in Interface Inc include Barrow, Hanley, Mewhinney & Strauss, and HOTCHKIS & WILEY. Their positions and potential influence on the stock's performance are noteworthy, as collective actions by major investors can impact market sentiment.

Transaction Analysis and Influence

The reduction in shares by Pzena Investment Management may signal a strategic move to rebalance the firm's portfolio or capitalize on short-term market fluctuations. Given the close alignment of the trade price with the current stock price and GF Value, the transaction appears to be a calculated decision rather than a reaction to a change in the fundamental value of Interface Inc. As the largest shareholder, Pzena's trading activities are closely watched and can influence the stock's performance in the market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

"interface" - Google News

February 12, 2024 at 07:05PM

https://ift.tt/KLkEoTs

Richard Pzena Adjusts Position in Interface Inc - Yahoo Finance

"interface" - Google News

https://ift.tt/OYuUlrD

https://ift.tt/Ni5y1Ak

Bagikan Berita Ini

0 Response to "Richard Pzena Adjusts Position in Interface Inc - Yahoo Finance"

Post a Comment