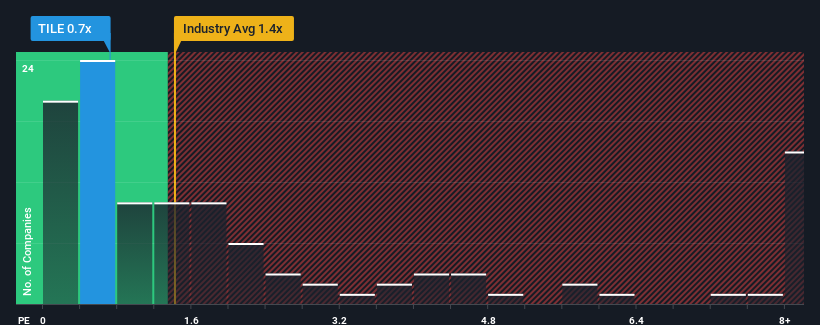

Interface, Inc.'s (NASDAQ:TILE) price-to-sales (or "P/S") ratio of 0.7x might make it look like a buy right now compared to the Commercial Services industry in the United States, where around half of the companies have P/S ratios above 1.4x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Interface

What Does Interface's Recent Performance Look Like?

Interface hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Interface's future stacks up against the industry? In that case, our free report is a great place to start.How Is Interface's Revenue Growth Trending?

In order to justify its P/S ratio, Interface would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 3.8% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 4.3% during the coming year according to the three analysts following the company. That's shaping up to be materially lower than the 9.9% growth forecast for the broader industry.

In light of this, it's understandable that Interface's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Interface's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Interface maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Interface you should know about.

If you're unsure about the strength of Interface's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Interface is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Interface is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

"interface" - Google News

July 14, 2024 at 10:56PM

https://ift.tt/8G7Kyf4

Investors Don't See Light At End Of Interface, Inc.'s (NASDAQ:TILE) Tunnel - Simply Wall St

"interface" - Google News

https://ift.tt/OnaMpUA

https://ift.tt/IcrDGuO

Bagikan Berita Ini

0 Response to "Investors Don't See Light At End Of Interface, Inc.'s (NASDAQ:TILE) Tunnel - Simply Wall St"

Post a Comment